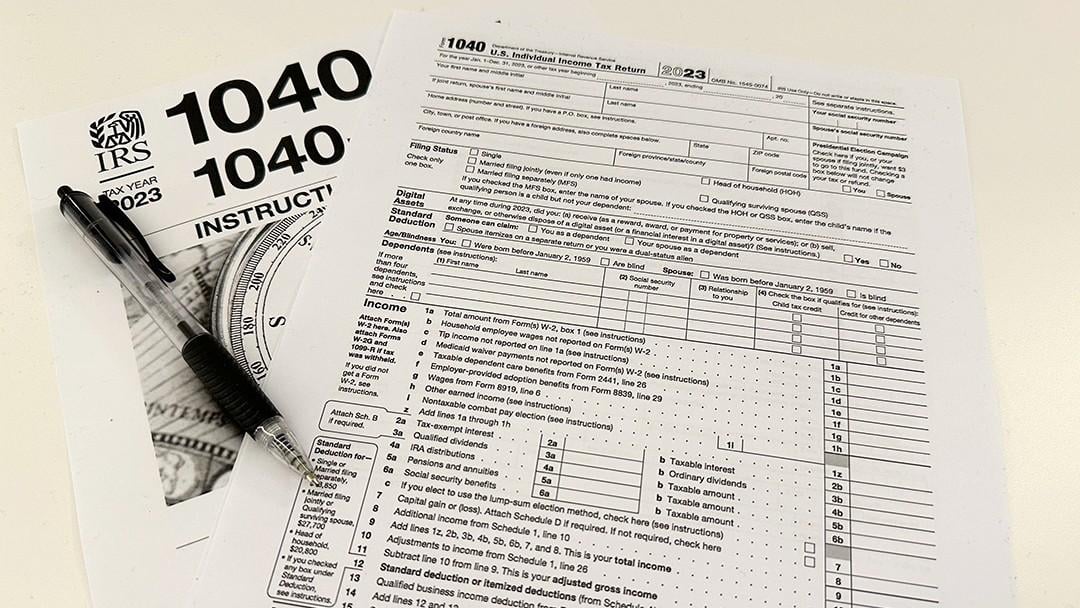

1040 2024 Example – There’s a lot to keep track of for tax season this year. Here’s what you need to know about checking your refund status, getting your money quickly and making sure you don’t miss any deadlines in 2024 . The credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April 15, 2024 at the latest $1000 over the limit. So for example, if a person earned $203,000 .

1040 2024 Example

Source : www.irs.govExample of private and shared memory trace construction from basic

Source : www.researchgate.netMore than 700K Michigan households getting tax credit checks in 2024

Source : www.clickondetroit.comWhat happened to Schedule C? (Q Mac) — Quicken

Source : community.quicken.comHow to Fill Out Your Form 1040 (2023 and 2024) | SmartAsset

Source : smartasset.comSolved: New and Improved! Lacerte Tax Form Availability Tool

Source : accountants.intuit.com603 Legal Aid Tax Information Session Tickets, Derry Public

Source : allevents.inHB 1040 Introduction to State Employers YouTube

Source : www.youtube.comTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comHB 1040 Introduction to State Employers YouTube

Source : www.youtube.com1040 2024 Example U.S. Individual Income Tax Return Income: This story is part of Taxes 2024, CNET’s coverage of the IRS penalties and interest if you file Form 1040-X and pay the extra amount.. An example could be if you forgot to claim income . Every dollar you win from gambling should be reported to the IRS, otherwise you could be fined or even go to jail. .

]]>